How To Make A Zero Based Budget

Budgeting Finance Paying Off Debt Saving || Tags: budgeting, Money ||A zero based budget is a simple way for beginners to create a budget thats easy to stick to so you can hit your finance goals. Here’s how to make one.

I used to hate budgets. I’ve tried so many times over the years to make a budget, and then never stick to it. I think the problem was I tried to create a budget that would work in every situation, not taking into account that some months we have a bigger power bill, or a lot of birthdays. I would get frustrated for “going over budget” and give up. It changed when I read about a zero based budget.

I’ve learned that a budget needs to be an ongoing process that is revisited in order to be successful. Every month is different. Of course there are things that stay mostly the same every month such as rent or a mortgage but for the most part expenses vary.

What Is A Zero Based Budget?

I found zero based budgeting when I started getting into the personal finance world. Popularized by Dave Ramsey, zero based budgeting means that you give every dollar you earn a “job”, like paying your groceries, paying off debt and going into savings.

I’m never going to be the person to tell you to cut everything “extra” out of your budget. If you are in severe debt or living paycheck to paycheck then there is likely some cutting you could do to your budget, however I am a big fan of paying for things that add value to your life. Things I may see as a waste of money may be important to you, so I wont tell you what to cut out of your budget.

I read a lot of articles about how much money you can save by not buying your coffee out every morning, or by cutting cable, but if you truly feel these things add value to your life, and you can fit them in your budget without going into debt then who am I to say you should cut them out.

How To Make A Zero Based Budget

1. Necessary Expenses

Write down your necessary expenses like mortgage, car insurance, internet, etc. which are always the same each month. You can include debt minimum payment amounts in here too.

2. Determine Income

Now determine your monthly income. If you have a salary or fixed income and you already know what your income will be, then subtract what your necessary expenses from step 1 from your income. If you are like me and your income varies, I know what my average income is and I make a *realistic* income goal based on what I have budgeted to spend that month.

Update: How I Budget With Irregular Income

3. Pay Yourself First

Pay yourself first by putting money into savings. I like to transfer money into savings accounts on payday so I don’t spend it first!

4. Estimate Variable Expenses

Estimate things like gas, groceries and power based on an average of what you have paid in past months. These are the variable expenses that tend to change each month. Don’t forget to include things like birthday gifts, or extra travel expenses depending on what you have going on that month. Irregular expenses tend to be the budget busters, so try to keep track of them.

I like to keep a list of what irregular expenses come up, so that I remember to budget for them. Things like yearly membership dues, our water bill that is due every 3 months, yearly exams for our pets, etc.

See Also: 3 Budget Busters & How To Combat Them

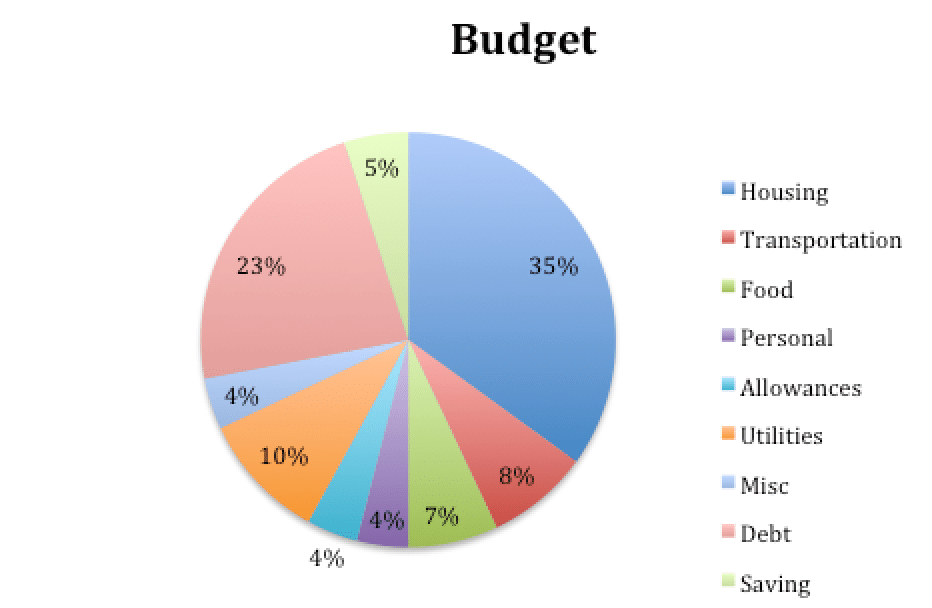

Budget Percentages

Because we never know exactly what our income will be for the month we are never exactly on target, but it’s a good guideline! This works for us, however you will have different expenses so you’ll have to rework the percentages! As long as it adds up to 100%, then you are good!

On average your budget should be as follows:

- Housing 25-35%

- Transportation 10-15%

- Utilities 5-10%

- Food 5-15%

- Debt 0-15%

- Saving 10-15%

- All else 25%

Debt Repayment

If you have debt, you’ll have to work debt repayment amounts into your budget. We started our debt repayment journey in September 2017, by declaring war on our debt, with the goal of putting as much money as possible on the debt. We worked the minimum repayment amount into our budget and then figured out how much more we could afford to pay monthly. At the end of every month, anything extra is always put into debt repayment.

More about debt repayment strategies

End Of Month Review

Every month I sit down and add up what we spent for the month to see how we did. I use my worksheet to keep track of everything, and then I make a budget for the next month. Spending about 45 minutes a month really helps keep me organized and in control of our money.

If you need some help getting organized, check out how we organize our money!

Tips For Sticking To Your Budget

We have been doing a zero based budget for a while and my number 1 tip for sticking to it, is know that sometimes you will go over budget, and that is okay! Expecting yourself to be perfectly on budget every month is going to lead to frustration and disappointment, and will make you want to give up. Having an accountability partner like a spouse or close friend is also a big help. You can cheer each other on and support each other through the times you really want to buy something out of your budget!

The Budget Binder

I created The Budget Binder to take the stress out of your finances with a system designed to help you pay off your debt, save money and feel financially free. It is a printable download with 32 worksheets to help you make a budget, track your net worth, and debt repayment with step by step instructions!

Final Thoughts

Budgeting has helped us in so many ways. We’ve been able to pay off our debt and travel way more often. Do you do a monthly budget? Or just wing it?

Pin it for later

One response to “How To Make A Zero Based Budget”

Leave a Reply

You must be logged in to post a comment.

[…] Read more here about how to make a budget! […]