How To Budget Bi-Weekly With Irregular Income

Budgeting Finance || Tags: budgeting ||Self employed or struggling to budget with irregular income? A bi-weekly budget may be the answer! Budget with the money you’ve already made and check your money more often.

If you’ve been following along through our debt repayment journey, you’ll know that we’ve been following the zero-based budgeting method for the last 2 years. I love this method because it gives every dollar you earn a “job”. It made paying off our debt way easier and faster, and sitting down monthly allowed me and my husband insight into our spending. But we had a problem with overspending sometimes…

Read how we paid off over $21,500 in debt!

Being self employed, I have some challenges with budgeting like:

- Income is variable

- Dependant on clients to get paid

- No vacation time

- No sick time or employment insurance

I won’t know until the end of the month what my pay is, which makes it frustrating to budget. It makes it really easy to go over budget if I have a low income month.

What Is Biweekly Budgeting?

With bi-weekly budgeting you only budget money you actually already have, instead of trying to anticipate what will come.

Every 2 weeks on payday I add up what we got paid and use that money to budget our expenses for the next 2 weeks. I still use zero-based budgeting, I just apply it to 2 weeks instead of the whole month.

Budgeting With Irregular Income

Budgeting with variable income can be very difficult. As someone who has been self employed for almost 10 years, I can tell you that no two months have ever been the same. My income is consistently in the same range, but for example, in July I took ⅓ of the month off (7/21 work days in the month) for traveling. This obviously put a huge dent in my income, which made it harder to budget.

With bi-weekly budgeting you only budget with the money that you have actually been paid. This makes it easier to deal with the swings in income.

One other way to deal with inconsistent income is to save some money on months where you make more than you need, and then in times where your income is lower, you could use this money to “top up” your income.

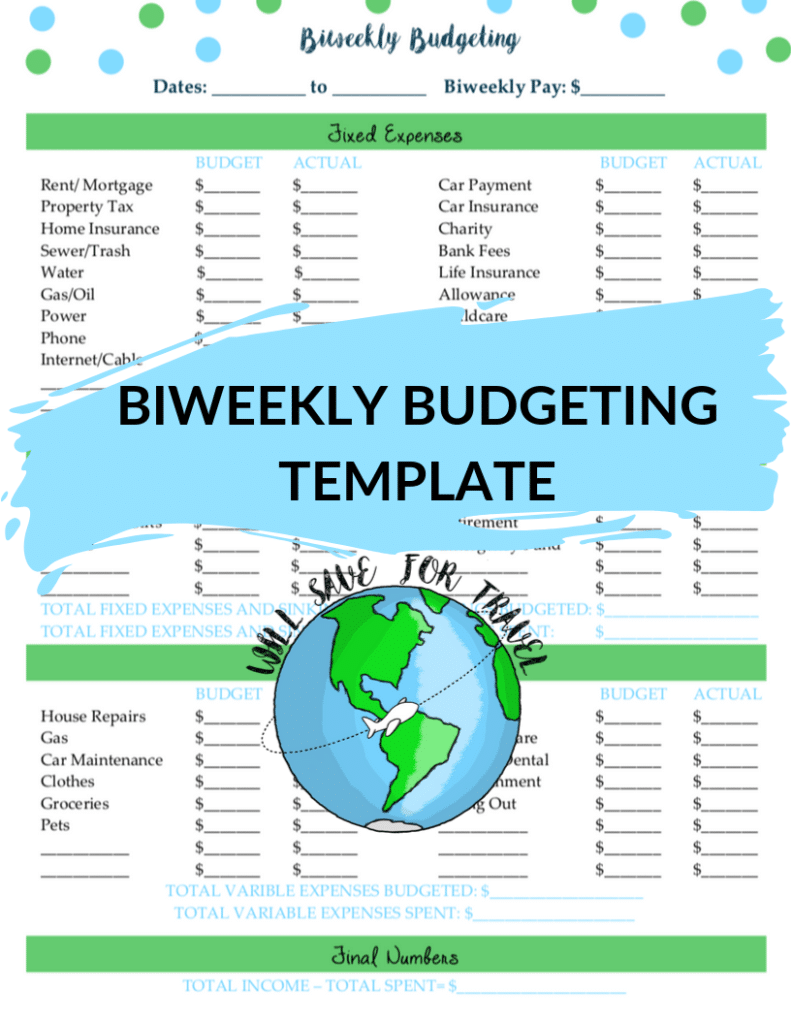

Bi-Weekly Budget Planner

I’ve added bi-weekly budgeting worksheets to my Budget Binder! This will give you the option to budget monthly or biweekly depending on your income. You can also buy just the biweekly budgeting sheets. I’ve been using these worksheets for the past 3 months and they’ve been so useful to me!

Get Your Budget Binder On Etsy!

How To Make A Bi-Weekly Budget

Before You Start

I found it helpful to list all your bills and when they usually come out of your account or when they are due. This helps you figure out what bills will fall during the 2 week period that you are trying to budget for.

Payday:

On payday (every second Friday for us) I sit down and add up the amount that we were just paid. I write that at the top of my worksheet

The next step is to write in the fixed payments for the next two weeks. For ease of budgeting I have set up my mortgage, all our retirement contributions and sinking fund contributions set up to automatically happen on payday.

Fixed payments include things like:

- Mortgage / rent

- Cell phone bill

- Internet bill

- House insurance

- Car insurance

- Life insurance

- Car payments

- Minimum debt repayments

- Charity/ tithing

- All sinking funds

- Retirement contributions

I add this amount up and then subtract it from our income, leaving me with the amount to divide up between our variable spending

Variable spending includes:

- Gas

- Clothes

- Groceries

- Eating out

- Entertainment

- Gifts

- Personal Care

- Pets

- Car & house maintenance

If you don’t need all of your income for variable spending, I would use it for debt repayment or savings goals!

½ Way Through Pay Period

About 1 week in I add up our spending on variable expenses like groceries, eating out and entertainment to see how much we’ve spent so far and how much we have left before the end of the pay period. This helps us keep on track. If we’ve overspent already then we know to reign it in.

Day Before Next Pay

Near the end of the day before our next pay period I add up the spending to compare it to the budget we made 2 weeks prior. A biweekly budget is a lot less time consuming to add up compared to monthly budgeting! After adding up what we’ve spent I subtract it from what we’ve earned. If that number is 0 – congratulations you’ve done zero based budgeting correctly! If that number is negative, then you’ve spent more than you’ve earned and you should probably revisit your budgeting. If the number is a positive number, then you’ve earned more than you’ve made. I would recommend using that money toward debt repayment or a savings goal. Using “leftover” money from our monthly budgets is what helped us pay off over $26,500 of debt in 21 months!

Start Over

Then it’s time to start over with the new pay period.

Helpful Tips On Biweekly Budgeting

One of the most helpful tips I can give you is trying to spread out your bill due dates as much as possible. If all your bills come out at the end of the month then one pay period will be harder to budget.

Make a master list of bills and their due dates that you can refer back to when you are making your biweekly budget.

Don’t forget irregular bills that come every second month or quarterly – which are water and power for me. You can create sinking funds for these and save each pay, or just deal with them when they are due – either way don’t forget about them!

Keep a “float” in your main bank account, just in case you overspend due to an emergency, etc. We’ve had instances that our pay didn’t get deposited on time due to a holiday but our automatic transfers still went ahead. If we didn’t keep a float we would have gone into overdraft!

Final Thoughts On A Bi Weekly Budget

Bi weekly budgeting has helped us tremendously with my irregular income. We have been saving more and checking in on our spending more often! I definitely think we’ll keep going with this method unless my job changes to something with a salary (haha, yeah that’s not happening!).

Leave a Reply

You must be logged in to post a comment.