Why You Need A Money Vision Board

Finance || Tags: Money ||Get clear on your money goals by getting crafty, choosing amazing photos and creating a financial vision board.

I made my first vision board when I was around 16 years old. I wish I still had it, or even a photo of it but sadly I don’t. The things I remember being on there are: see a play on Broadway (CHECK!), go to Greece (ALMOST check, #duetocovid), and learn how to dance (I started adult ballet a few years ago).

I’m sure there are things on that board that I haven’t accomplished yet but it was such a great reminder of the things I wanted to do with my life.

While scrolling Instagram one day, I found a few personal finance bloggers sharing their money vision boards, and I thought that was such a great idea! You can see a bunch under#financialvisionboard

Okay but WHY do I need a vision board?

Vision boards aren’t magic. Just because you put a picture on a board doesn’t mean it will come true, but focusing on your goals will help you get clear on WHAT you want, and then what you will have to DO to make it happen.

You will have to do a bit of soul searching here. Journal what you want your life to look like, and what money moves you’ll have to make to achieve that.

How To Make A Financial Vision Board

Sit down and start writing a list of things you’d like to accomplish financially, maybe retiring early or funding your child’s college education.

You should also consider things that are important to you, like supporting small businesses traveling, donating to charity, buying a home, etc.

The other things you should consider are HOW you want to make money. Do you want to work for a certain company? Only work part time? You can put all of those things on your vision board too.

There are no rules! Your vision board is yours and can be whatever you want!

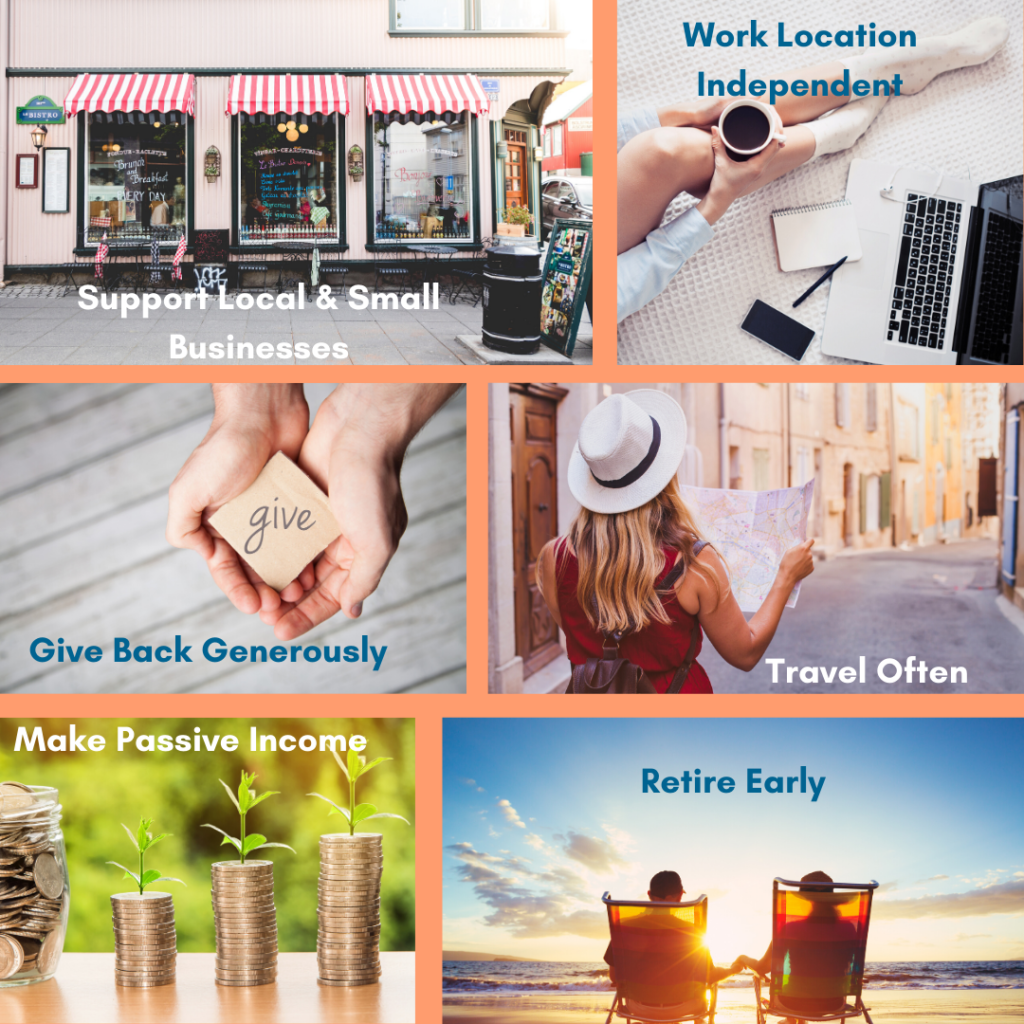

What’s On My Financial Vision Board

Support local and small businesses – I have been pretty vocal about the fact that I am no longer supporting Amazon. We continue to buy locally roasted coffee, and many other items. I can’t wait to support more local businesses for Christmas gifts and more!

Work Location Independent – I have been a massage therapist for the last 10 years, which definitely ties me down a lot. My husband became location independent last year, and I am planning to make a career change soonish!

Give Back Generously – One of the great parts of being out of debt and living within our means is that we can give back to organizations that support causes we are passionate about. We currently give a little but I’d like to give a lot more in the future!

Travel Often – In an ideal world I would like to travel 4+ times a year. I’d also like to live abroad for a few months at a time (remember the working remotely thing? This is why!). We average 1-2 big trips a year (not this year of course) right now. I can’t wait to see more places.

Make Passive Income – passive income is income you can make in your sleep! Setting up streams of passive income means I won’t always have to trade time for money.

Retire Early – I really don’t want to wait until I’m 65+ to retire! I’ve written before about FI/RE and I’m definitely more excited about that possibility! Although we’re not going to save 50% or more of our income at this point, we’re hoping to make some big money moves in 2021!

Final Thoughts

It never hurts to get clear on your goals! You can make your board online using a free service like Canva, or you can make one the old fashion way with a bulletin board and some magazine photos.

Leave a Reply

You must be logged in to post a comment.