What Is Net Worth and How To Calculate It

Finance || Tags: Money ||You might be wondering “what is net worth?”. One of my goals for last month was to figure out our net worth. I had heard the term many times in the personal finance world, and I knew basically what it was, but I had no idea what my net worth actually was. I also didn’t know why it was important! So I started reading to figure out what this number means.

What Is Net Worth?

Net Worth is a very simple calculation: assets minus liabilities = net worth. It’s a way to measure your financial health. Your net worth can be negative if you owe more than you own. The higher your net worth the more money you have available to you.

How Do You Calculate It?

You add up the value of the things that you own, like a car, house, and the amount of money in your bank account and retirement accounts. Then you add up your debt, like student loans, credit card debt and mortgage. You subtract these numbers to get your net worth.

Why Is It Important?

Net worth provides a snapshot of your financial health. Everyone’s net worth will fluctuate but tracking it over time will help you see if you are going in the right direction. You may think you are in a great financial spot if you have $20,000 in the bank, but if you have $10,000 in student loan debt and a mortgage you’re actually in a worse spot than someone with $10,000 in the bank and no debt. Net worth gives you a better overall picture.

How To Increase Your Net Worth

There are two simple ways to increase your net worth: Increase your savings/ investments and decrease debt. Both of these will have a positive effect on your net worth!

What Is MY Net Worth?

My net worth is technically the net worth of both my husband and me. We have joint accounts and it would be difficult to separate our assets and liabilities.

Assets

House – $260,000

We bought out house almost 3 years ago, we’ve done some upgrades and estimate that we could sell for around $260,000 if we put the house on the market today.

Car – $10,000

According to canadianblackbook.com our car would be worth about $10,000 if we sold it today.

Retirement Savings – $9049.91

We have separate RRSP accounts that we contribute to every month.

Emergency Fund – $3456.66

We have a small amount of emergency savings while we are paying off debt. I plan to beef this up when the debt is gone!

Vacation and House Project Savings – $2852.73

Money we have saved for upcoming vacations and house projects we have planned.

Other Accounts – 6355.75

Our joint account and our personal accounts.

Liabilities

Mortgage – $218,846.79

We bought our house 3 years ago with a total mortgage of $242,113.20.

Student Loans – $12,857.41

If you’ve been reading this blog, you know we’ve been working hard to get rid of this debt!

Total Assets – $291,715.05

Total Liabilities – $231,704.20

NETWORTH – $60,010.85

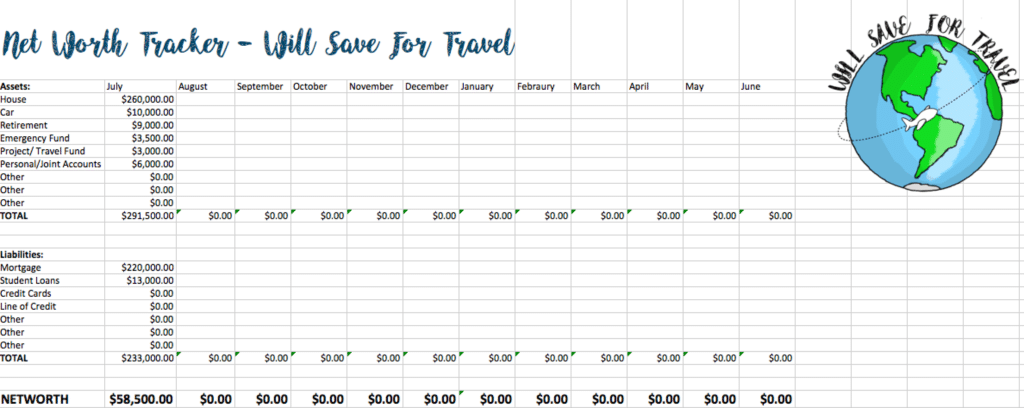

I have made this handy excel sheet for you to track your own net worth! It will even do the math FOR you!

Sign up here to get it emailed to you!

I hope that helped you answer the question “what is net worth?”!

Pin it for later

Leave a Reply

You must be logged in to post a comment.