Declaring War On Debt

Finance Paying Off Debt || Tags: Debt ||It’s about to get real here today. It took me a little while to decide to share our actual debt numbers with you.

First a little bit of our story; I took a 2 year diploma program in massage therapy, which I got student loans to fund. Luckily when I graduated I only had about $15,000 in student loans and I was able to pay it off in 5 years instead of the typical 10 by making more than the minimum payments. My husband took a 4 year music degree and also a 1 year paramedic program, both of which he had student loans for. Unfortunately we are still paying for my husband’s student loan. Fortunately I have been pretty financially savvy (Thanks Dad!) and I have never had any credit card debt. Our car is also paid for, so the only debt we have is my husband’s student loan and our mortgage.

Up until recently we have been paying the minimum monthly payments on the student loan and pretty much ignoring it. I decided I had enough of including it into our budget and I don’t wait to wait 7 more years for it to be gone.

The Numbers

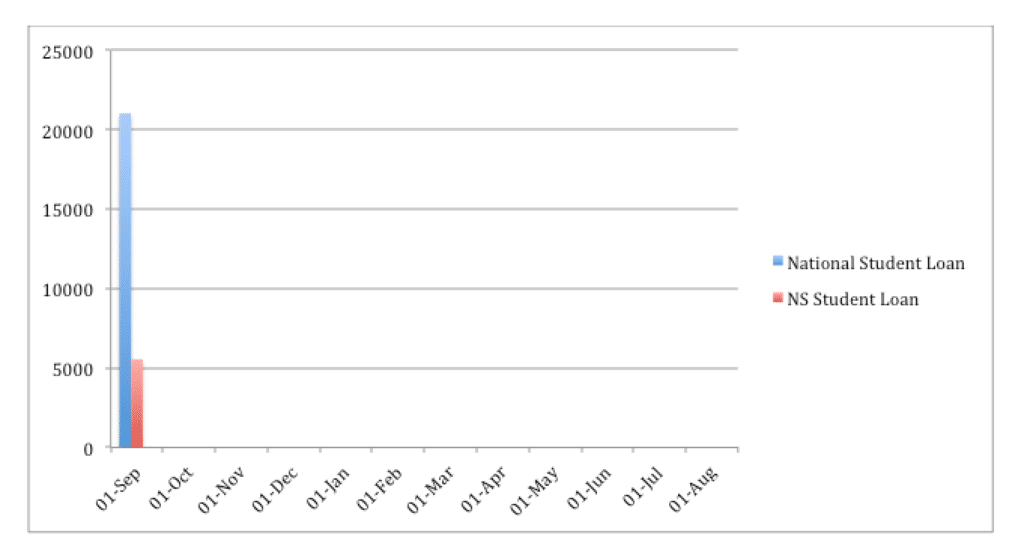

The national student loan totals $21,009.14 and the Nova Scotia student loan totals $5547.50. The national student loan averages just over $3 a day in interest, while the Nova Scotia student loan doesn’t accrue any interest. Based on this we will be tackling the larger national student loan first, instead of using the popular snowball method.

We have made a goal to pay this off in 2 years or less! Meaning we’ll have to pay around $1200 a month towards our debt. A scary number but we have worked out a plan to do it! We have upped the monthly payment to $700 a month on the national student loan and will add more payment at the end of the month depending on how much money is left over in our budget.

So our debt free date is September 30th 2019! I’m excited to bring you along on this journey, sharing with you definitely helps with accountability. I’ll post regular updates for you to follow along!

Do you have any debt repayment goals?

Leave a Reply

You must be logged in to post a comment.