How We Paid Off $26,000 Of Debt In 21 Months

Budgeting Finance Paying Off Debt Saving || Tags: budgeting, Debt, Money ||WE ARE DEBT FREE

Holy crap you guys, we have been debt free for one whole week now! Of course I planned on writing this sooner, but the day after we became debt free I left to go to my hometown for a little staycation with my best friend while she was in town. I decided not to do any “work” which included not even picking up my laptop once. Sorry to keep you waiting!

First I want to thank you all for all the love we got this past week and throughout this whole process. I truly think that if I hadn’t put this blog out there in the world that we probably would not have stuck to our goal. Thanks for being our accountability partners!

I want this post to be a summary of our debt repayment journey, so I’m going to start at the beginning, if you’re more interested in what’s happened in the last 3 months, and what’s next, just skip down a few paragraphs.

Declaring War On Debt

In September 2017, this blog was only a few months old. Being a personal finance blog I was just getting my handle on budgeting monthly and I knew it was time to start tackling the debt. After we added it up, our total at the time was $26,556.64. If we continued to pay the minimum payment on that debt it would have taken us 7 years to pay it off. We decided we wanted it gone in 2 years or less, which meant we had to average about $1200 a month to pay it off, which was a good chunk of our monthly income.

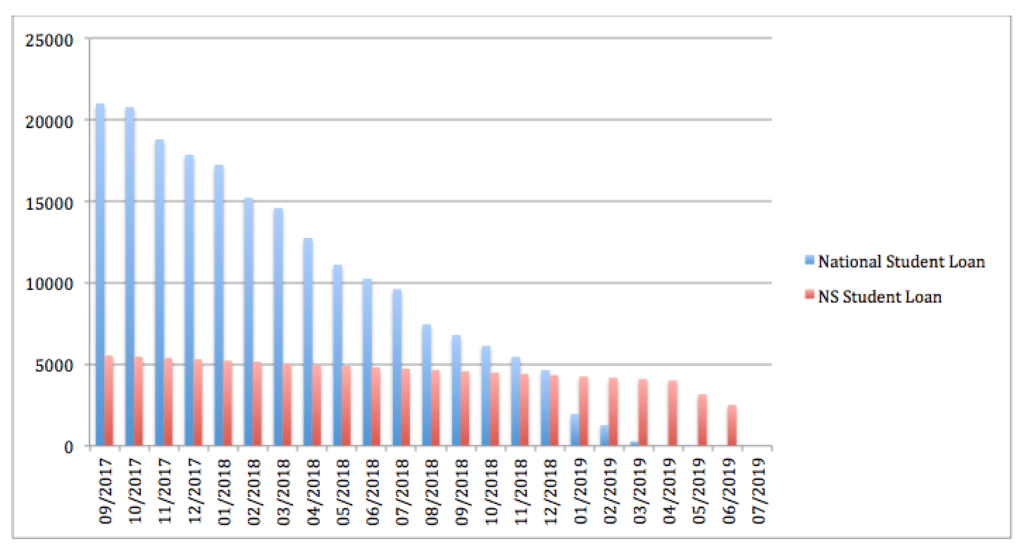

We decided to do the avalanche method to pay off our debt, so we set our sights on the National Student Loan which was $21,009.14.

Our plan was to budget monthly and always add any leftover money from the budget to the debt, as well as using any “bonus money” to pay it down faster.

Read Also: How To Make A Zero Based Budget

3 Months Of Debt Repayment

(October- December 2017)

The first 3 months of paying off our debt felt really good. We managed to pay $3395.58 in those first 3 months, which felt especially amazing because it was leading up to Christmas. We had a few bonuses because of a rebate from Efficiency Nova Scotia for putting in a heat pump (which we had paid cash for) and I had a mistake on my paycheck that lead to me getting $800 back. I remember going into 2018 feeling excited about our progress so far, and made it my goal for 2018 to be under $10,000 in debt.

6 Months Of Debt Repayment

(January-March 2018)

In the first 3 months of 2018 we were able to pay off another $4386.60, bringing our total debt down to $18,455.41. It felt so good to be in the teens! Our 3 pay month in December helped us put an extra $1400 on the debt in early January, and but then at the end of January we had no extra money to spend. In February we challenged ourselves to our first (and so far only) No Spend Month, which we were able to put an extra $1200 on top of our regular payment of $780.80. I also created the debt repayment tracker that month, which has been on my fridge ever since!

9 Months Of Debt Repayment

(April – June 2018)

In the second quarter of 2018 we were able to pay off another $3691.14. Those 3 months we didn’t do too much besides pay the regular payment of $780.80 and put a little extra money toward the debt. I had just gotten back from Vegas and we had booked a trip to Florida as well. Originally I had thought about not traveling during our debt repayment journey. The people who follow Dave Ramsey would have told me not to, but we decided that we were okay with traveling because we weren’t going further into debt to travel, and most of the travel money was coming from my tips anyway.

I think it was around this time that I decided that personal finance is personal, and we were on track to meet our debt repayment goals, so we traveled!

Read Also: Why We Aren’t Following Dave Ramsey Exactly

1 Year of Debt Repayment

(July-September 2018)

At this point we thought we were half way into our journey, even though we had paid off more than half of the debt at that point. I was nervous to move up our debt free date in case we didn’t make it. In the 3rd quarter of 2018 we paid off $4450.12 by making our regular payments and putting all the extra at the end of the month on our debt. Summer is a little bit slower for me at work so I remember feeling discouraged by my lower income, but ready to make the most of my busiest season – leading up to Christmas.

15 Months Of Debt Repayment

(October-December 2018)

By the end of the year we were under $10,000 in debt, meaning I had hit one of my big goals for 2018. Thanks to a 3 pay month in November, we paid off $3645.66, so we were sitting at $6987.54. I had also sold some things online which gave me a little extra cash to put on the debt as well. Around this time I had started my Facebook community: Money Talks with Will Save For Travel, and everyone in there has been a great source of inspiration and support.

Join The Money Talks Community on Facebook

18 Months Of Debt Repayment

(January-March 2019)

Going into 2019 I was certain that we would be debt free before September and I made my new goal to be debt free by the end of June. We didn’t have a lot of extra money these months so it was mostly just our regular payments plus an extra $200 in January. At the end of March we had officially paid off the National Student Loan and were down to just the Nova Scotia student loan, which was interest free. We owed $3812.30. I remember feeling excited that the National Student Loan was gone, but I also started to feel frustrated that we were not done yet. $3800 felt like such a small amount that I just wanted it to be over. I briefly considered draining my Tax Free Savings account which is my emergency fund to pay it off. Thankfully my Instagram followers talked me out of it, and we stayed the course.

21 Months Of Debt Repayment

(April-June 2019)

I was pushing for us to be debt free by the end of June. I needed this part of our journey to be over, and it felt like it was dragging on forever. In April my husband got a tax refund of just over $1000 but I didn’t put it on the debt right away. We had drained our baby emergency fund to pay for repairs that our car needed, so I held onto his refund just in case something came up. In April we only managed to pay $650. May was a 3 pay month for us and I was excited to put a big chunk onto the debt, and we were able to pay $1665 at the end of May. By the beginning of June our balance was $1497.30 and I was trying to find a way to be debt free at the end of the month. I knew we weren’t going to have that much extra in our budget which lead me to finally using my husband’s tax refund to pay off most of the balance.

At the end of June my final payment would bring us to being debt free! Of course my regular payment date is the last day of the month which was a Sunday, and Monday was a holiday for Canada Day, so our final debt payment FINALLY came out of our account on July 2nd making us debt free!

So, What About Your Mortgage?

I got a few comments online that we aren’t really debt free because we still have a mortgage. While I am inclined to agree with them because a mortgage is technically debt, we didn’t include it in our original goal because of 2 reasons: we would incur penalties to pay it off early, and it’s such a huge number I know we would get discouraged and give up.

Later when I found the Total Money Makeover by Dave Ramsey, he suggested tackling the mortgage after all other debt, and building a large 3-6 month emergency fund.

I do plan on paying off our mortgage early but it’s not going to be a priority for us right away. We will be renewing our mortgage next year and at that time I plan to come up with a game plan to pay it off early. Right now our mortgage sits at $210,045.77. We are already paying it off faster by paying it bi-weekly.

What’s Next?

If we were following Dave Ramsey’s baby steps, our next step would be saving a larger emergency fund which would keep us from going into debt again if one of us were to lose our job or otherwise not be able to work. However that’s not really our plan. Our next goal is to save money for a new car in the next 1-1.5 years. We’ve had to do a lot of work on it this year and it will likely need to be replaced by then, so we are saving so that hopefully we won’t have to acquire much (or any) debt to get a new car!

My next focus is also going to be on building our retirement fund. My goal is to increase our RRSP contribution to 10% of our income for now, since we are just figuring out budgeting after debt! Likely we will increase this in the future but I wanted to make sure there was some cash flow available for saving for the new car.

Overall it feels great to be moving on from the debt repayment journey. I can’t wait to see what happens next!

Share it to inspire others!

2 responses to “How We Paid Off $26,000 Of Debt In 21 Months”

Leave a Reply

You must be logged in to post a comment.

Amazing job, you should be so proud! Now you can start investing in your future and get that car – upward and onward friend!!!

Thank you so much! It’s so exciting to move on and work on another goal!!