3 Months of Debt Repayment – Progress Report

Finance Paying Off Debt || Tags: Debt ||It’s been a couple months since I told you that my husband and I have declared war on debt. I wanted to give you a little update and let you know how we have been doing.

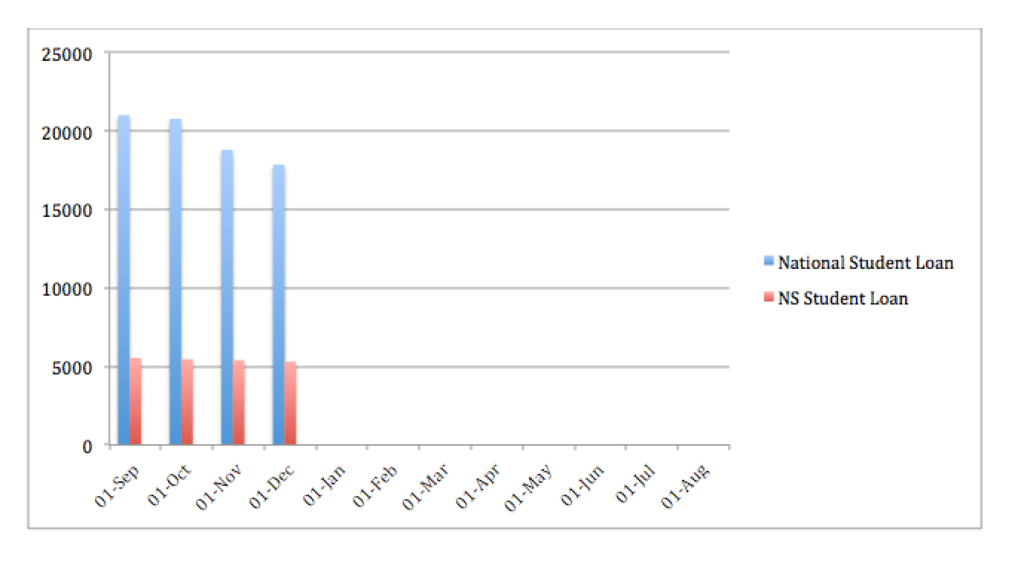

I’m so excited to share with you that since October we have paid off $3395.58 of our debt! In October I upped the regular payment on the larger National student loan to $700 a month, the smaller NS student loan is $80.80 a month. We’re not really focusing on the NS one right now because it doesn’t accumulate any interest.

How Have We Done It?

In September I found a mistake on my pay check from the massage clinic I work at, which ended up with them owing me about $800. I put that directly on the National student loan. In October we also got a rebate of $550 from Efficiency Nova Scotia for putting in our heat pump, and I also put that on the loan.

We have been doing monthly budgets for a few months. At the beginning of the month I estimate how much we’ll spend depending on what we have going on that month, which gives me an idea of how much income we’ll need to have. At the end of the month I add up our income, and our expenses. Whatever money is leftover after our expenses and savings goes on to the student loan. In November I was able to add another $330 onto our regular payment. I’m hopeful to put a big chunk in December, as it is a 3-pay month for both of us!

Normally most of that “bonus” money I mentioned would go directly into our travel fund. It’s been a little sad for me not to see our travel fund going up. I do plan to travel a wee bit before we have the debt paid off as long as we’re on target though; I am a travel addict after all!

I hope this has inspired you to start paying off your debt. Please share with me some of your successes lately. I will continue to update you periodically with ours!

Leave a Reply

You must be logged in to post a comment.