The Magic of Compound Interest

Finance Paying Off Debt Saving || Tags: Money ||AKA Why You Still Need to Save and Invest When You Have Debt

When you’re in debt a lot of people might advise you to throw ALL your money at the debt until it is gone. But what about saving, or investing? Should you ignore that while you pay off the debt? I don’t think so and I want to tell you why.

~*~Compound Interest~*~

Compound interest is magic and I wish I had learned about it sooner because it would have changed the way I saved for buying my house. By starting to save earlier you’ll have to save less in the long run because the magic of compound interest will help you get to your goal. Compound interest works by accumulating interest on the whole balance and not just the balance you’ve paid in. Meaning you get interest on interest. Not sure what I mean?

Let me show you the math:

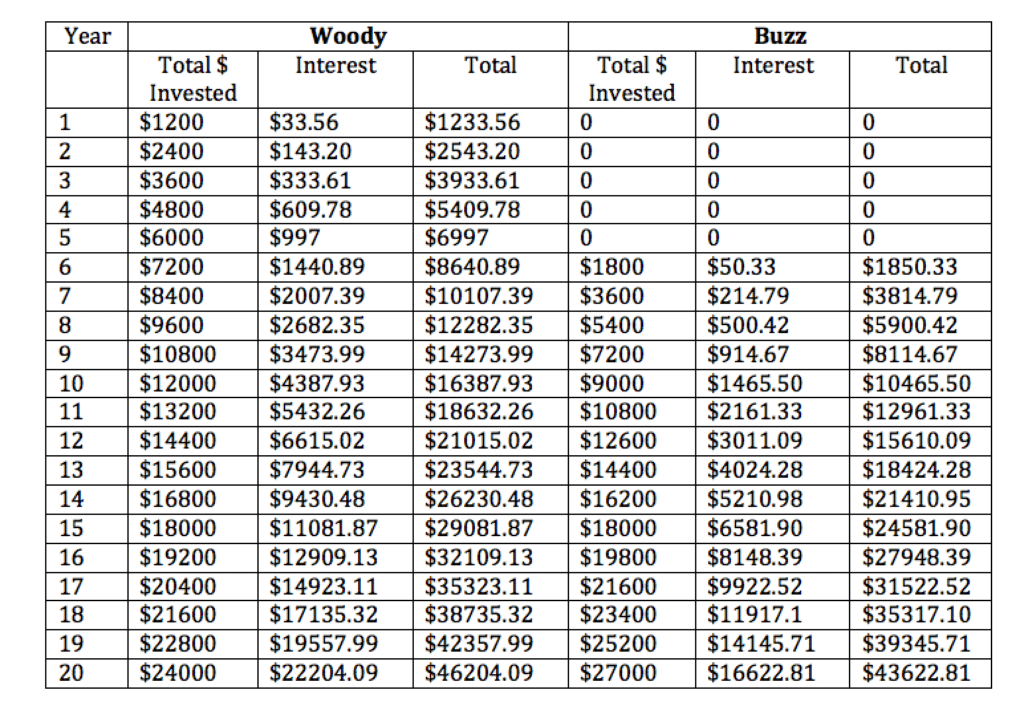

Let’s say Woody and Buzz Lightyear are saving for retirement (I literally just watched Toy Story! Haha). Anyway Woody starts saving $100 a month right now and he has 25 years before he retires. Buzz pays off all his debt in 5 years and then starts saving $150 a month in year 6 to catch up. Let’s assume they are investing this money and getting an average of 6% return each year.

You can see Woody invested $24,000 of his own money but now has $46,204 thanks to compound interest. Buzz invested $27,000 of his own money and now has $43,623, which means he invested more money but ultimately ended up with less money because he has less time to invest. For most people this would mean working longer rather than retiring when they want to.

What About the Debt?

As you’ve learned by now investing early is important, but what about the interest you are paying on your debt? Let’s assume Woody and Buzz both have $20,000 in student loans (is there a Toy University? Pixar should get on that). The loans have an interest rate of 5%. They pay $400 for about 5 years until it’s paid off. They will have paid $2440.38 in interest in that time. Considering Woody paid $3000 less into his retirement fund, and got about $2500 more money than Buzz, Woody still wins!

How Do I Start?

I would start by making a budget, and figuring out how much money you can allocate towards debt repayment and saving. You don’t HAVE to invest $100 a month right away, $50 or $25 a month will still help you in the long run if you bump up the saving after the debt is paid off.

I hope this has inspired you to start saving and investing right now!

PS you can get my super simple budget worksheet by signing up here. I use it every single month and it helps me know how much I can throw at my debt.

Pin it for later

One response to “The Magic of Compound Interest”

Leave a Reply

You must be logged in to post a comment.

[…] Read more about investing while in debt […]