My Why – A Personal Post

Personal || Tags: Personal ||I’ve been doing a lot of reflection over the past week that we’ve all been self isolating at home, I’m sure some of you have too! As Will Save For Travel is coming up on 3 years old, I wanted to share with you my personal story through money and debt, travel and life

I was never “good at money” as a child, I spent it all. My younger brother was the “saver”. I would spend it all on junk from the dollar store and when I was older, clothes, makeup, things at Claire (remember that place? Does it still exist?!), you know, all the stuff teenage girls spend money on.

My first trip on a plane was in May of 2002. We went to Texas. I remember a little about that trip, mostly that we had a lot of fun visiting with some family that lived there. We went to Disney in 2003, I had been wanting to go to Disney World ever since I knew it existed. We had an amazing trip. We went to Ottawa, Quebec City, Alberta, PEI, and New York City. My family loved to travel and so did I.

Fast forward a bit and I feel like I got “better” at money in my late teens and early 20s. I got a lot better when I graduated massage therapy college and started my “real adult job”. I knew I didn’t want to be paying my student loan for 10 years so I threw some extra money at it, and paid it off in 6 years.

I definitely didn’t think I’d ever be self employed. I assumed I would go to college, get a job for a company and live happily ever after… spoiler alert – that didn’t happen.

Most massage therapy jobs (at least around here) are contract work. I took a contract with a national franchise (I never would have imagined I’d still be there 10 years later but that’s a whole other story!). Being that I work for a franchise, they handle all the marketing, and the billing. I handle things like treating my clients, submitting HST to the government and my own income tax. As a contractor, I only get paid if I have clients. Most of the time work is steady, but the varying and unpredictable income is a challenge.

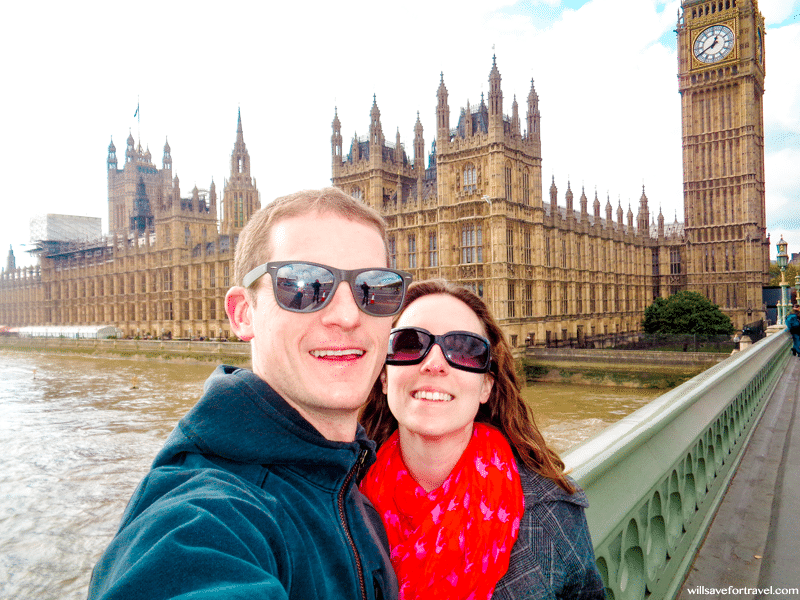

In the meantime I started dating the man that would become my husband. We moved in together, and managed to save for a trip to Disney in 2011. We were in debt, and our income wasn’t much but we had saved for it and had a great trip. I knew I wanted to travel more, but with our student debt, and lower income. It was difficult. We managed a few trips though, saving as much as we could.

My husband went back to school, which of course added to his student debt, but in the long run he was able to make a higher income, so it worked out. I worked 6 days a week for a few years in order to pay for our wedding while he was in school.

For a few years it felt like we were struggling to really get any traction. It felt like spinning our wheels and not getting anywhere. We wanted to buy a house, and we wanted to travel but it was so hard with student loan payments, and a car payment.

I don’t remember the exact time when I realized that we needed to get out of debt if we ever wanted to travel more. But I do remember buying a house and then realizing that all of our “extra money” was gone to mortgage payments, property tax and house repairs.

We needed to pay off the debt so that we could have that money back.

I started Will Save For Travel as a way to share our journey, to be accountable to “someone” and to show others that it was possible.

We started budgeting, paying off the student loans with small extra payments, and sometimes with big extra payments. We still traveled while we paid off debt by saving for it. Things started to look up…

You know how some moments will stick with you forever? I don’t know if I’ll ever forget when my parents told me that my step mom has cancer. Life comes to a screeching halt. My step mom is one of my favorite people in the whole world, and her influence is one of the major reasons I love to travel.

Over the last few years I’ve realized why I love travel so much, and as cheesy as it sounds it’s all the memories that I’ve made. I got to experience so many things with so many people through travel.

Things I’ll never forget like our family trip to New York, seeing my first Broadway show. Visiting Iceland with my step mom and being frozen on a boat in the ocean looking for the Northern Lights (we didn’t see any). Seeing Disney decorated for Christmas with some of our best friends just this past December. Going to NYC for the best wedding ever. Going on a cruise with my Mom and step dad and finally dipping my toes in ocean water that doesn’t make you go numb. Going to see an NHL game with my best friend and falling in love with Minnesota. Seeing Chelsea FC play at Stamford Bridge. Long car drives with my brother and I in the back seat. Every trip with my husband that always leads to an adventure I didn’t expect.

Some people might wonder how personal finance and travel could be related. How can I blog about responsible money management and then turn around and book a trip to Disney?

Well, my friends, without the money management I couldn’t have made some of these memories. Some of my favorite things I’ve ever done never would have happened (or maybe they did happen and then I was stressed about the crippling debt it created after).

Travel is my WHY. Money is my HOW.

Leave a Reply

You must be logged in to post a comment.