A Decade In Review

Uncategorized || Tags: Personal ||I can’t believe that not only are we heading into a new year – but a new decade! Things have certainly changed for us! I thought it would be fun to look back at the last 10 years to see all the progress we made financially, and also just life in general. The days, months and years all add up! By making small changes over weeks and months, our situation changed drastically for the better!

2010

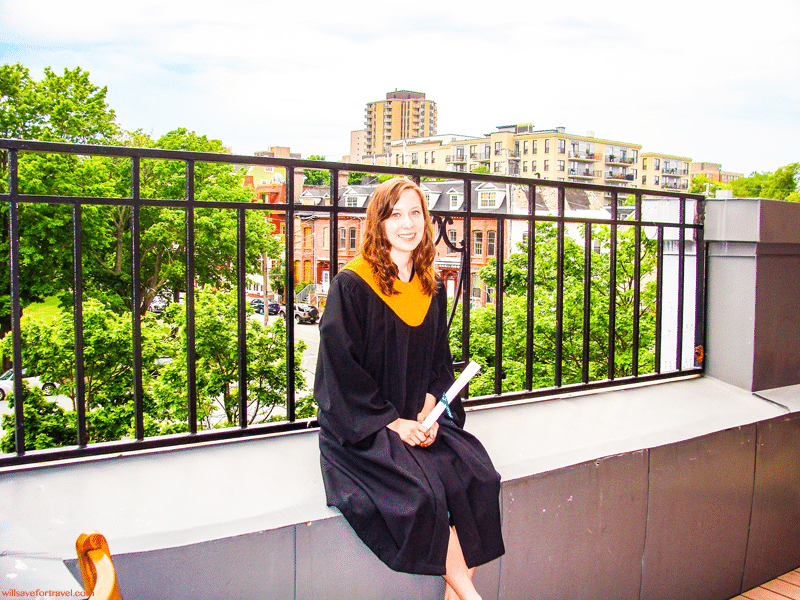

I graduated massage therapy college in June of 2010, so for the first half of the year I was living on student loans and some money I had saved from my highschool job and from working in the summer. My husband and I had been dating for about a year and we moved in together in June 2010. It was a big year for us!

I started my massage therapy career in August, and finally got my first “grownup” paycheck! It was slow going at first because I was new and still building my clientele, I was actually scared I had made a huge mistake! Over the last couple months my income started to increase as my clientele grew.

When I graduated college, I had accumulated about $15,031.34 in student loan debt. My husband also had student loan debt from his 4 year university degree, and a brand new car – and the payment that came with it! It was definitely a struggle navigating paying back loans and getting our first apartment together.

Between my student loan, my husband’s and his car our debt would be approximately $54,588.64

2011

As I settled into my career my income became more steady and I felt more confident managing my finances as a self employed massage therapist. I wasn’t making a lot but my husband and I split finances 50/50. Luckily at this time we weren’t taking on any consumer debt but we were struggling to get the student loans under control. In the spring we added a little poodle spaniel mix to our family: Ellie! We also took our first real trip as a couple this year – to Disney! I paid for the entire trip with tips, sort of a precursor to sinking funds!

2012

Not much of note happened in 2012 as far as I can remember! My husband was trying to figure out his career and had worked a few jobs in a few different fields. We made enough to cover our bills and travel a little. I made my first trip to Thunder Bay to visit my best friend that year. We refinanced the car to TD instead of with Honda to save some money on interest.

2013

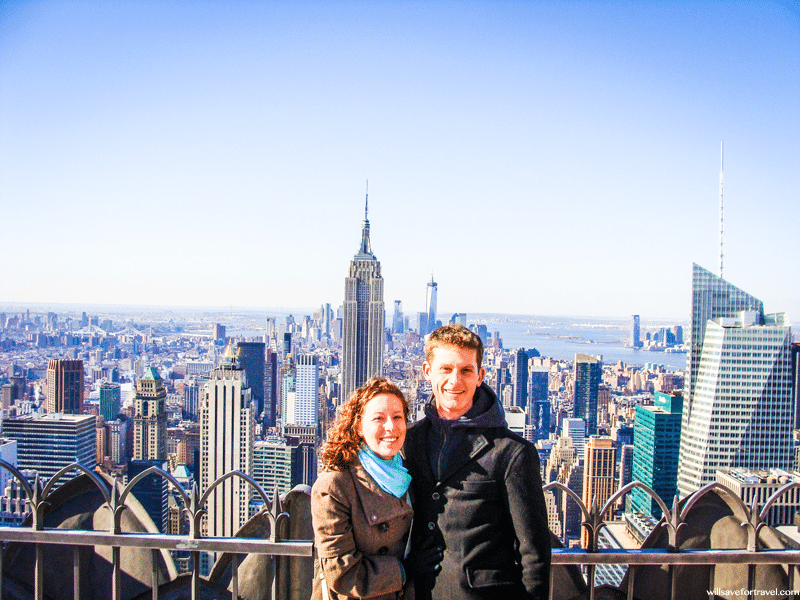

Early in the year we got to go back to one of my favorite cities – New York! My husband decided to go back to school in 2013 to take a paramedic program, which meant that I would be the only one working for about a year. It was a scary leap but I worked 6 days a week to cover the bills while my husband furthered his education. Unfortunately this meant adding $9450 to his student loans. We made it work and I even squeezed in a trip to Iceland with my step mom in October, which is still one of the best trips I have ever taken!

2014

For the first half of 2014, my husband was still in school, and I was still working 6 days a week. On June 1st my then boyfriend became my fiance when he proposed on a hike in Cape Split (one of the best hikes in Nova Scotia!). This meant we started saving for a wedding and honeymoon. He graduated from his paramedic program in the late summer and began the hiring process (which lasts forever) and he worked a retail job in the meantime. It was so nice to have a second income again!

2015

This is what you might call a banner year! 3/4s of the year was saving as much as we could for our wedding, honeymoon, and then for our house downpayment. My husband started his paramedic job and we were finally back to two full incomes. In June we started house shopping and we ended up putting an offer in on a house about 2 weeks before our wedding which was on August 1st! I can’t say I recommend that timeline! A week before our wedding we had the home inspection and we closed on September 15th, about 3 weeks before our 14 day Europe honeymoon began. Thanks to saving as much as we could and the generosity of our friends and family through wedding gifts we managed not to take on any debt from the wedding, or honeymoon. We had saved enough for a 5% downpayment on our house, and we took on $242,000 mortgage.

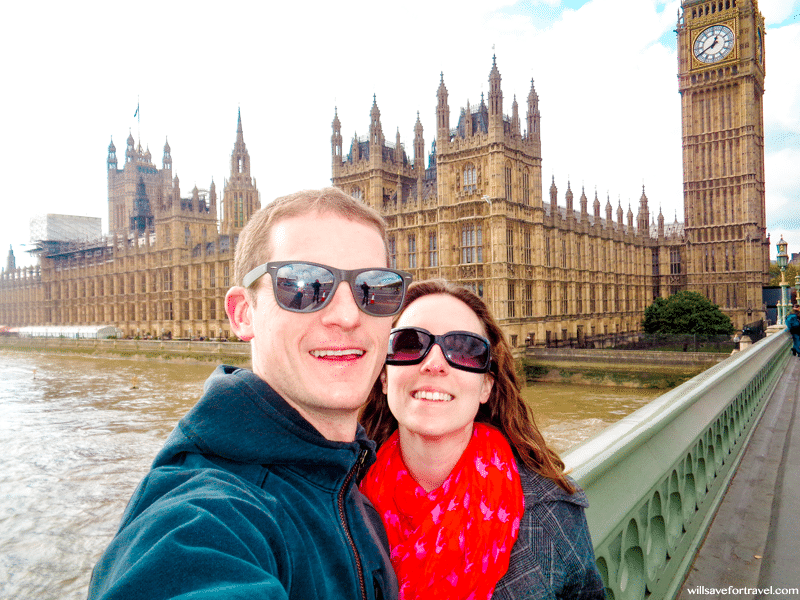

Our honeymoon took us to Iceland, then London and Paris. We had such an amazing time, from seeing a Chelsea FC game to visiting Disneyland Paris I am so grateful we got to spend those 2 weeks together after the stress of a wedding and buying a house all within 45 days!

We also finally paid off Ryan’s car loan and I paid off the last of my student loans.

2016

2016 was a quiet year compared to all the fun things we got to do in 2015! We settled in to home ownership by doing a few projects around the house – mostly finishing the fence in the backyard and then adding stairs off the deck so we could enjoy our little property. We did lots of local traveling because we had depleted all our savings the previous year. I did manage a trip to Thunder Bay and Minnesota to visit my BFF.

2017

We started the year by traveling to NYC in January for a friends wedding, and it was an amazing time and a great way to start the year! In the winter I started to think about writing a blog but I had no idea how to build a website or even buy a domain. I eventually mentioned it to my husband (I was so nervous that he’d think it was silly!!) but he responded with the fact that he was interested in learning code and he started learning and building my website. In June we finally got back to Disney World after 6 years, I had missed it so much. In July Will Save For Travel was born! Putting our lives and finances on the internet was one of the scariest things I have done but it has been such a positive in our lives. Of course in September 2017 I wrote that we were ready to seriously tackle our debt and we made a plan to pay it off in 2 years. Our debt was $26,556.14, not including the mortgage.

We finally started budgeting more frequently (and successfully) and I was surprised at where our money was going.

2018

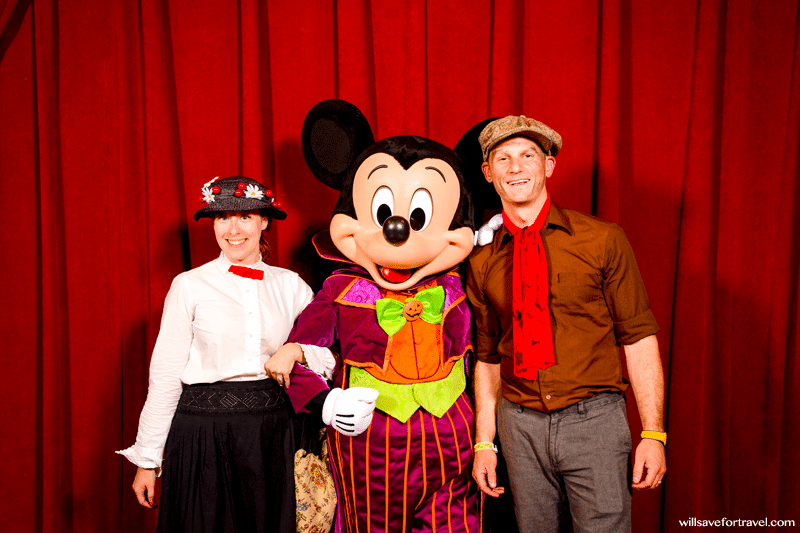

If you’ve been reading a while you probably know most of the next 2 years were full of paying off debt. After finally getting serious we managed to pay off $16,246.84 in one year. On the travel side of things I got to go to Las Vegas with my best friend in the Spring, which was an amazing trip and then back to Disney World in the fall with my Husband. Disney at Halloween was one of my favorite experiences!

2019

We started this year on a Bahamas cruise and exploring Miami with my Mom and Step-Dad in early January. It was so much fun, and nice to be warm in January! In July we finally made our last ever student loan payment and became debt free except for the mortgage! It was such a great feeling, I was so relieved that part of our financial journey was over because it freed up so much room in our budget! In August we explored Toronto and Niagara Falls to celebrate our anniversary, birthdays and becoming debt free! We finished up our year by traveling to Disney once again – this time to see all the beautiful Christmas decor.

The Next Decade

I hope the next decade will bring a lot more traveling (duh, why else would I name my blog Will Save For Travel?!). Other than that I’m not really sure what the decade holds. I believe I’ll make a career change in the next 10 years, and it’s possible that we will move. I’m excited to see what adventure life will throw at us!

Any highlights you want to share about the last decade?!

Leave a Reply

You must be logged in to post a comment.