Debt Snowball vs Debt Avalanche

Budgeting Finance Paying Off Debt || Tags: budgeting, Debt, Money ||Once you’ve decided to pay off your debt, you’ll have to come up with a game plan. You’ve probably heard of terms like debt snowball and debt avalanche before, not knowing what they are. These are the two best ways to pay off debt quickly and efficiently. I guess the third option would be just throw money at whatever, but that doesn’t sound quick or efficient 😉

Pin it!

Learn more about our debt repayment journey:

Declaring War On Debt, 3 Month Update, 6 Month Update, 9 Month Update, 1 Year Update, 15 Month Update, 18 Month Update

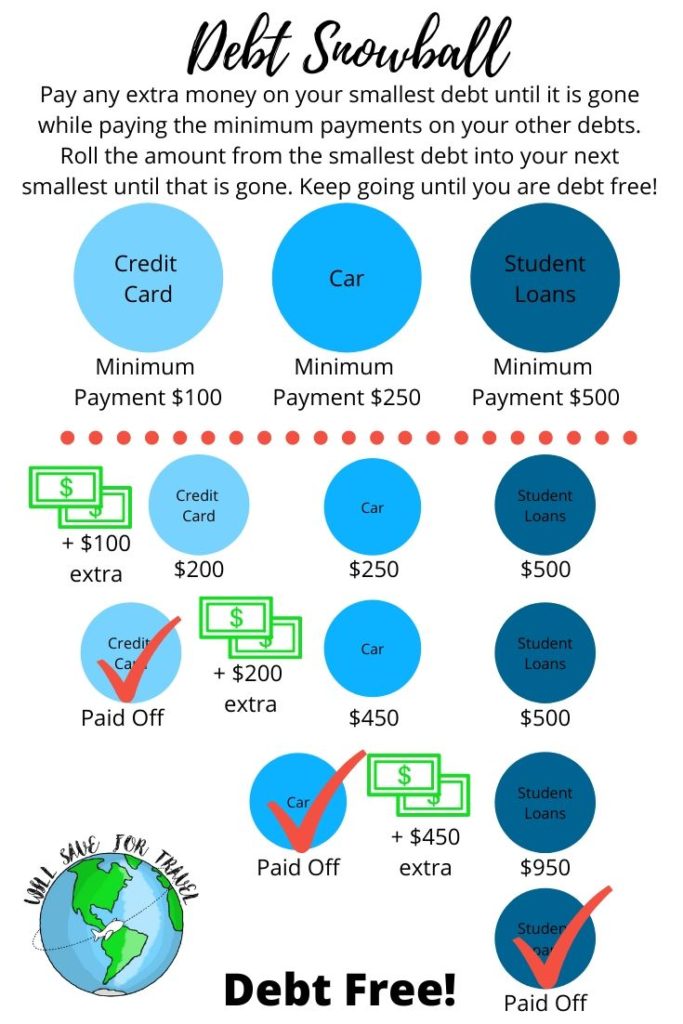

Debt Snowball

The debt snowball has been popularized by Dave Ramsay. His method is to list all your debts from smallest to largest, while paying the minimum payment on all the debts, you’ll focus all your extra payments on the smallest debt until it’s gone, and then start with the second smallest and so on until they are all gone! The idea behind this method is to get some quick wins so you’ll be more motivated to keep going. The only downside to this method is you may end up paying more in interest on your loans.

This method is for you if: you need to stay motivated by knocking off some debt quickly, or you have so many different kinds of debt that you are overwhelmed.

How To Set Up Your Debt Snowball

Let’s say you have 3 debts: $2500 on your credit card, $5000 on your car and $10,000 on your student loans. You would pay the minimum amount on each debt, but use any extra money on the small debt; the credit card first. Once the credit card is paid off you use the money you were paying on the credit card and add that to the car payment, then once the car is paid off you add that amount to the student loans. See how the snowball is building momentum as it goes down the hill?

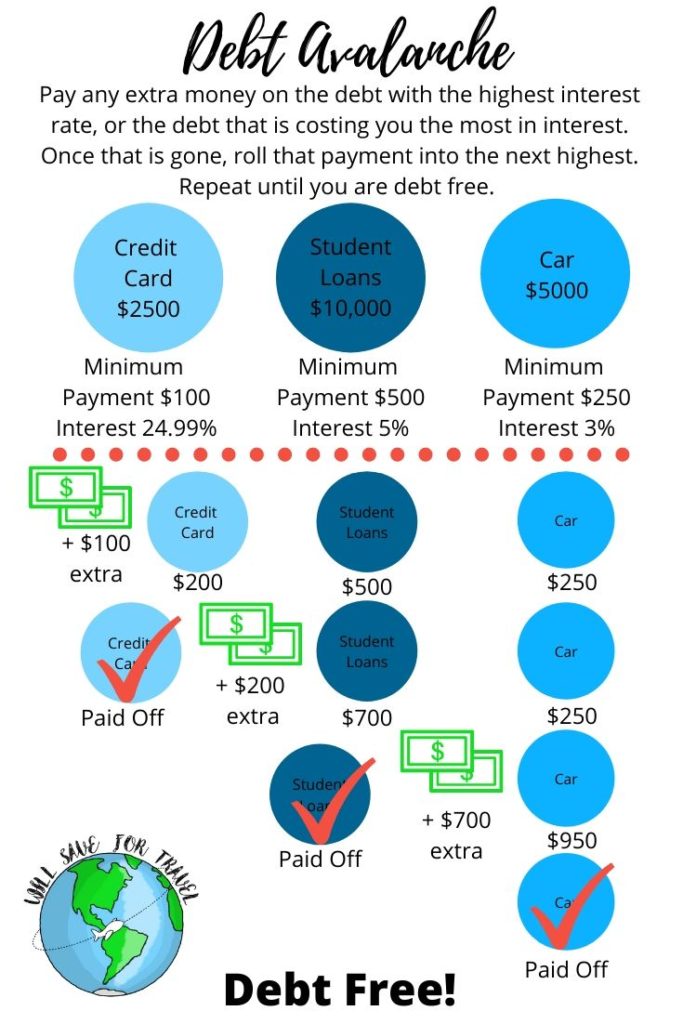

Debt Avalanche

The debt avalanche makes the most sense mathematically. You’ll list all your debts from highest to lowest, including the interest rate, and figure out which is costing you the most in interest. The one costing you the most is the one you’ll tackle first with extra payments, while making the minimum payments on your other debts. This way you’ll minimize the amount of interest you’ll pay. This is the way we’ve been tackling our student debt. Although it can be hard to stay motivated, I feel better knowing we are saving on our interest!

This method is for you if: you have high interest loans like credit cards, or only have 2 or 3 different kinds of debt, or if you like doing things the logical way 😉

How To Set Up You Debt Avalanche

Let’s take the same 3 debts from earlier but add their interest rates:

Credit card: $2500 balance at 24.99% interest

Car: $5000 balance at 3% interest

Student Loan: $10,000 balance at 5% interest

To calculate your daily interest charge for any loan divide your interest rate by 365 and then multiply it by your current balance.

Credit Card: 0.2499/365= 0.00068466 x 2500= $1.71 per day

Car: 0.03/365= 0.00008219 x 5000 = $0.41 per day

Student Loan: 0.05/365=0.00013699 x 10,000= $1.37

So using the debt avalanche method you would pay off the credit card first, then the student loan, and lastly the car.

Implement Your Plan

No matter which debt repayment plan you choose, you have to make a plan and execute it. This starts with your budget! You’ll have to figure out how much your minimum payments are, along with how much you can afford to throw at your debt! Our minimum payment for both the debts combined is 173.37 but over the past 6 months we’ve averaged $1494.13 per month! I had NO idea we had any extra money lying around before I started a monthly budget. It seemed like money would just come and go but we weren’t making any progress on our goals. Once I started making a monthly budget, and checking in at the end of the month I noticed some months we had some extra to throw at the debt, and some months we overspent and had to reign in our spending.

To make a budget you’ll write down all your expenses and compare it to your income. If you spend more than you make, you’ll have to address that by making more, or spending less.

Read all about the zero based budgeting method

Final Thoughts

The only wrong choice you can make is to not pay off your debt at all! I know it can be overwhelming coming up with a plan, but in the long run it will be worth it. Trust me, life is so much better debt free! So which plan will you choose? Let me know how it’s going!

One response to “Debt Snowball vs Debt Avalanche”

Leave a Reply

You must be logged in to post a comment.

Debt avalanche is my option… at the moment, I have positive debt so I’ll pay that from the money I make as a result of my company investments…