How To Organize Your Personal Finances

Budgeting Finance Paying Off Debt Saving || Tags: Debt, Money, Saving Money ||Overwhelmed by your money? Here’s tips on how to best organize your personal finances with simple steps to take back control.

Spring has sprung, and that always has me thinking about spring cleaning! Have you ever considered organizing your financial life part of spring cleaning? Finances can be overwhelming to most of us, papers can take over, and it makes us feel stressed and disorganized. I’m going to show you had to literally organize the mess, and how to set yourself up for future success!

Clean Out The Papers

This step may be challenging, especially if you don’t have a filing system in place already! It is worth it to take a day and get your papers organized into a system that works for you. Once you do this, every other year’s Spring cleaning (and tax time) will be so much easier.

Shred Old Documents

Anything you don’t need, including tax returns over 8 years old, make sure you shred them! A lot of financial documents have personal information on them, and you don’t want that to fall into the wrong hands! Recycle the shreddings 🙂

Make A Filing System

We have a filing cabinet that I store all our old tax returns in, receipts for major purchases like appliances, debt repayment documents, and mortgage documents. They are all labeled in folders.

I also have a smaller file folder where I keep receipts for everything we purchase all year. At the end of the year I get rid of everything we don’t need for tax purposes etc. I keep all our receipts just in case we need to return something, or I want to cross reference with my online banking.

You don’t have to use the same system I do, make one that makes sense for you!

Check On Retirement Contributions

Another part of your yearly spring cleaning should be going over your retirement contributions. Are you saving enough? Should you be saving more? And has your risk tolerance changed due to your circumstances?

These are questions you should go over with your spouse and your financial professional to make sure you are on track to retire when you want to.

Update Your Budget

Or make one if you haven’t already. Budgets should be living documents, growing and changing to meet your needs.

We have been budgeting biweekly for almost a year now, and we budgeted monthly for about 2 years before that.

Read more about starting a budget.

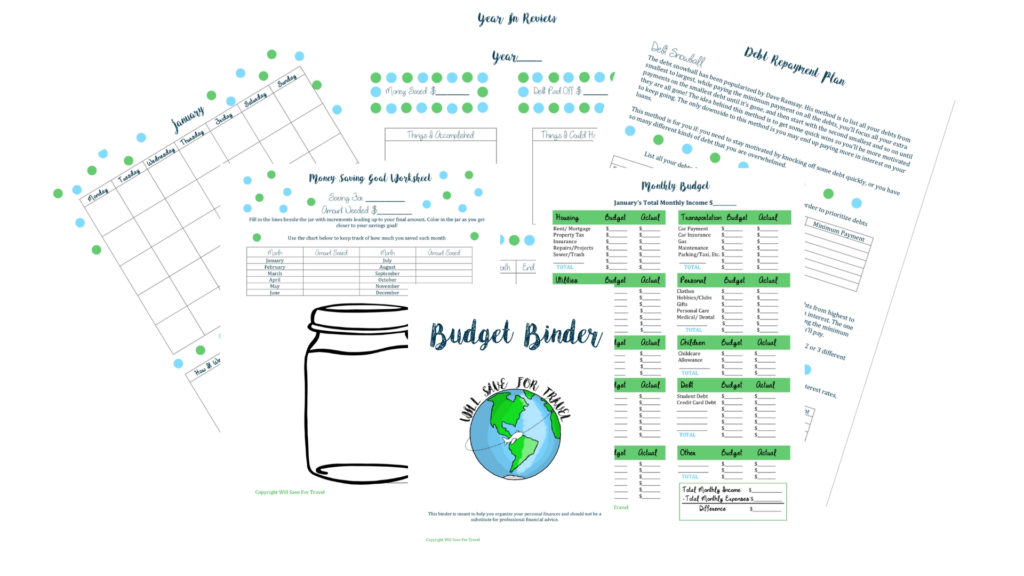

If you’re looking for a personal finance organizer, check out The Budget Binder! It will help you make a budget, track your net worth, save money and be more organized.

Update Sinking Funds

When updating your budget, go over your sinking funds and set some up if necessary. We have sinking funds for our power bill, travel, Christmas and a new car.

Some other sinking fund ideas are:

- Kids sports fees

- House maintenance

- Back to school shopping

- Wedding

Basically anything that will be a large cost in your budget!

Read more about sinking funds!

How To Organize Your Bills

Spending a little time organizing your bills will help budgeting go much smoother.

1. Write Them Down

As part of your budgeting, you should have all your bills written down and their due dates. This will make budgeting so much easier, because you won’t forget them! Don’t forget irregular bills like annual dues.

2. Change Due Dates If Necessary

I have a lot of my bills come out of my bank account every 2 weeks on payday. By having them come out on my payday, I can’t accidentally spend the money on something else and then not have enough to pay my bills.

3. Automate Savings & Bills

We also have our retirement savings, and sinking funds automated to move into different accounts on payday. It is easy to set up in online-banking. By automating our bills and savings we pay ourselves first, to make sure we don’t incur interest on our bills (and/or debt) and we are saving for the future.

Make Financial Goals

I have been making financial goals either monthly or quarterly for the past 3 years. Making goals helps you stay focused, and helps by giving you a sense of accomplishment when you finally achieve your goal.

Here are some ideas for financial goals

- Pay off debt

- Make / stick to a budget

- Save for a large expense like a house downpayment or a new (to you) car

- Sell items you don’t use

- Build your emergency fund

- Have a no spend week/month

Make A Debt Repayment Plan

One of your financial goals might be to make a debt repayment plan. We paid off $26,500 in 21 months by doing the debt avalanche method. Meaning we paid off the highest balance with the highest interest rate first.

Some people prefer the debt snowball (the lowest balance) method. Either way, make a plan that includes paying the minimum balance on each debt, and then paying extra on one debt until it is gone.

Read more about debt avalanche vs debt snowball methods.

Get the debt repayment tracker emailed to you for free!

Final Thoughts

I know this seems like a lot of work, but it doesn’t have to be done all in one day! Spread out the tasks, and you’ll be much better off in the long run! This system will help you organize and save money. Happy Spring cleaning!

Leave a Reply

You must be logged in to post a comment.