Emergency Fund: Things You Need To Know

Budgeting Finance Paying Off Debt Saving || Tags: Money ||It happens to all of us, we’re minding our own business, living our life and then WHAM! Out of no where something expensive happens, or we lose our jobs. That is why you need an emergency fund to help you deal with life’s unexpected adventures, because it’s not an IF, it’s a WHEN.

What Is An Emergency Fund?

If you’re just getting started on your personal finance journey, an emergency fund is an account of money that is set aside for emergencies such as a job loss, or an unforeseen expense.

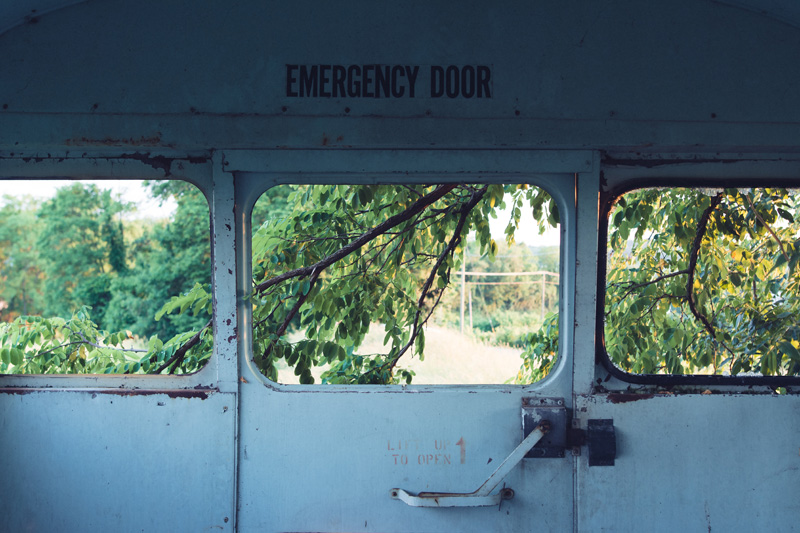

You should always have access to an emergency door! Photo by Joel Peel on Unsplash

You should always have access to an emergency door! Photo by Joel Peel on Unsplash

Why Do I Need One?

You need to have some funds set aside for emergencies because it’s not IF an unexpected event will happen, it’s WHEN will it happen. As the saying goes, expect the unexpected. The car will need repairs, you will have unexpected medical expenses, an appliance will break down and you need to have a safety net available to deal with these situations.

Where Should I Keep An Emergency Fund?

Your emergency fund needs to be somewhere you can access it quickly. I have mine in a high interest savings account, it has no fees or minimum balance and I can access it by transferring funds into my checking account. If you have it in a mutual fund or TSFA then there may be a waiting period to get your money or early withdrawal fees that you don’t want to have to worry about!

How Much Do I Need?

This is widely debated. Dave Ramsey suggests building up a $1000 emergency fund before you pay off any debt, so that in case of emergencies you aren’t adding to the debt you are trying to pay off! I completely agree with him and it’s what we have saved right now while we pay off my husband’s student loans.

If and when you have no debt it is suggested to have 3 to 6 months of expenses set aside. This looks different for everyone. If your job is stable then you can probably err on the side of 3 months. If you are self employed or employed in an industry where layoffs happen often then you may want to save 6+ months to feel comfortable.

You don’t have to save 3-6 months of your current expenses, since if you are in an emergency situation you will likely go without eating out, entertainment, etc. until you are back to normal.

Read More: Emergency-Proof Your Finances

How can I save enough money?

According to a survey in 2016 by the Canadian Payroll Association 48% could not make ends meet if their paycheck was delayed by a week, and 24% could not come up with $2000 in an emergency situation. That’s a whole lot of people living above their means and not saving.

If this is you, don’t worry, the fix is simple, but not easy. Spend less than you make and save the rest. I know “easy for you to say!” is what you are thinking, but it is essential to being financially healthy. Sell things you don’t need or use, take on extra shifts at work, and cut your variable spending.

What SHOULDN’T I Use It For?

The emergency fund is not for things that aren’t emergencies. The trip you want to go on isn’t an emergency. New clothes, shoes, TVs etc. aren’t emergencies either. Things like a new roof, regular car maintenance, and regular medical expenses should be saved for in a different way, because they are planned expenses that you usually see coming in advance.

Sinking funds are a great way to save for expenses that you KNOW are coming.

Final Thoughts

There’s no time like the present to start preparing for an emergency! Do you have an emergency fund? If not, what is stopping you from having one?

Pin it for later!

You should always have access to an emergency door! Photo by

You should always have access to an emergency door! Photo by

Leave a Reply

You must be logged in to post a comment.