The 7 Bank Accounts You Need

Budgeting Finance Saving || Tags: budgeting, Money ||The 7 bank accounts you need that will make your life easier and your finances more organized. Make your money work for you!

When you think of bank accounts, you may just think of checking and saving accounts, but to be truly organized, you may need 7 or more bank accounts!

I know this might sound crazy to some of you but hear me out. Spend a little time setting this up and then it will manage itself! This is one of the easiest and best things I did to organize our finances. If you set up the right bank accounts it shouldn’t cost you much or anything in fees.

The Bank Accounts

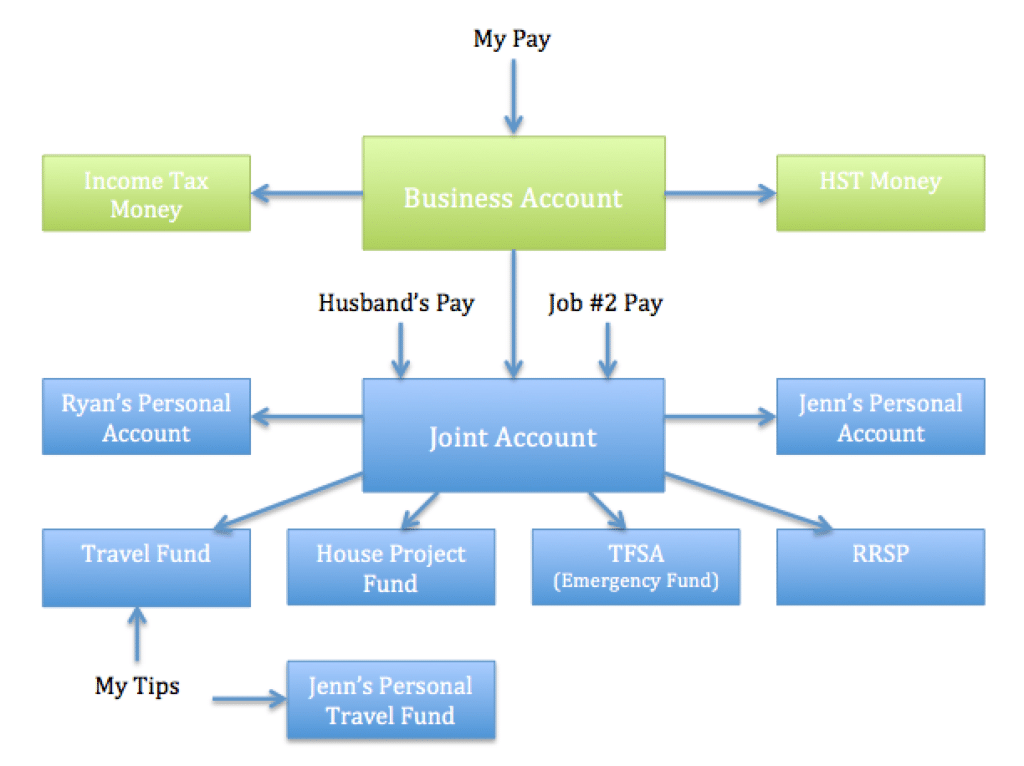

My husband and I have 9 bank accounts plus a TFSA and an RRSP. For me it is easier to have money separated into accounts so that I know what it is for! I work as a self-employed contracted massage therapist so 3 of the accounts are related to me having my own business.

Let’s break down these accounts and what they are for:

Business Bank Account, HST Money & Income Tax Money

As a self-employed/contracted massage therapist I get paid per massage. The company pays me and includes the HST collected, which I have to submit to the government quarterly. Also Canada Pension Plan and income taxes are not taken off my paycheck so I transfer money into this account to pay to the government quarterly as well. After all that money is transferred into the separate accounts, what’s left over is my take home pay and is transferred into our joint account. Obviously if you’re not self employed you can skip this step!

Joint Account

Arguably the most important account of the whole system, this is the epicenter for everything that happens. If you are single or not sharing finances with anyone then just call this your Main Account. My husband and I combined finances so this is our joint account. I have this money in a checking account with unlimited transactions because of everything that happens here, which does come with a monthly fee, but that is waived with a minimum monthly balance. There are several transactions happening here: I have automated transfers set up each payday to my Tax Free Savings Account (TFSA) and RRSP. Once monthly money transfers into our Travel Fund, House Project Fund, and our Personal Spending Fund. Our mortgage, groceries, gas, debt repayment, house and car insurance and general expenses all come out of this fund with automatic withdrawals and our debit cards.

Our Personal Accounts

This was something we decided on when my husband and I combined our finances. This is also in a checking account accessible with our debit cards. Once a month $100 transfers into our personal bank accounts to use however we want. I mostly use this money on going out with friends and haircuts! But the point is we can spend it however we want. If you’re single or not combining finances I would still urge you to set this account up and use it as your fun money each month.

Travel Fund

Our travel fund gets money each month from our joint account, and I also sometimes get tips from my clients, so most of my tips go to our travel fund. This is in a high interest savings account and not accessible from our debit card so when we want to use the money I use our debit or credit card and transfer the money over.

House Project Fund

Once a month we put money into this account. We use this money for house projects. We used it to pay for the pool we got this year, and it also serves as a savings account if we need to replace something large like an appliance, or if repairs are needed to our car. This is also in a high interest savings account and not accessible from our debit card so when we want to use the money I use our debit or credit card and transfer the money over. This is a great example of a sinking fund.

TFSA and RRSP

Our TFSA houses our true emergency fund if once of us were to lose our job, or not be able to work we would have this money to fall back on. I contribute bi-weekly to my RRSP; it serves as my retirement savings.

My Personal Travel Fund

I put some of my tips in here as well, as I have a few trips planned with my best friend and my Mom. Also in a high interest savings account, the same as the ones above.

Other Accounts You May Want

*updated 2019* Since implementing this strategy we have added a few more accounts. We have started a sinking fund for Christmas so that we add $50 every month and by December we will have $600 toward Christmas gifts. You can do the same with any big expense that you know will be coming up like a roof repair, any home renovations, a car purchase, etc. The sky is the limit and it will make paying for a large purchase so much easier if you have the funds waiting for you.

How Does It All Work?

For the most part all of these transfers are automated, which means I do nothing. It’s worth taking the time to set up the accounts and the automatic transfers because once that is done it takes care of itself! Having automatic transfers allows you to pay yourself first and meet your savings goals easier. None of this really works without having a budget to tell you how much you can afford to save.

Obviously all these accounts don’t apply to everyone so set up your own! If you’re saving for a wedding, a house, or another large purchase open a high interest savings account and set up automatic transfers to it.

I promise once you get this set up it will make your life easier and more organized!

Pin it for later!

Leave a Reply

You must be logged in to post a comment.