Why Personal Finance Should Be Taught In School

Finance || Tags: Money ||I’ve been out of high school now for about a decade. I think it’s natural over time to realize that they didn’t teach us everything we should know before heading out into the world on our own. We simply didn’t know what we didn’t know. If you had a job in high school you probably learned a few money management lessons but not enough to really know how to budget.

The fact is a lot of our parents are in no place to teach us how to manage money. In 2016, the average Canadian owes over $8500 in consumer debt, and 12% of Canadians owe over $25,000 in consumer debt. People aged 35-54 (Gen Xers, my parents generation) have an average debt of over $10,000.

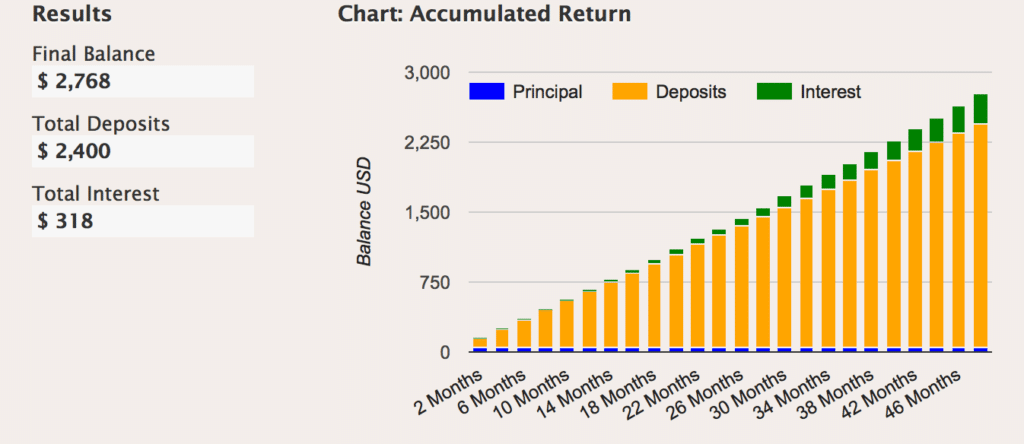

The Earlier You Start The Better

I think this lesson applies to almost anything but it DEFINETLY applies to investing. The earlier you invest, the faster wealth will build and with less money invested overall. I would tell any 18 year old to start an RRSP (registered retirement savings plan in Canada) as soon as possible. Only got $50 a month? Whatever. Start building compound interest right away. Whenever you can afford to add more do it. If you invested $50 a month in 4 years you’d have $2768.42 (assuming 6% return on investment). That’s more than most 22 year olds have saved after finishing a 4-year program!

You Have To Pay Back Those Student Loans

A lot of people I know who went to college or university had to take out student loans in order to go to school. I don’t think that student loans themselves are a bad thing but when I was receiving mine, I didn’t think about the fact that I had to pay them back, or that I could be paying them back for 10+ years if I didn’t accelerate my payments. I know I spent some of that student loan money on things I didn’t need.

And You Have To Pay Back Credit Cards

After high school you often get your first credit card, likely with a small limit. If you use it correctly then you’re building your credit report in a positive way that will help you get things like a mortgage later on. If you’re using it the wrong way you’re getting yourself into unnecessary consumer debt that will likely follow you for a while.

Your Budget Won’t Magically “Work”

In high school I remember doing an exercise where we had to make a budget. I don’t feel like we really took into account fluctuating costs, debt repayment or general life expenses. When I first started budgeting I would try to make a budget that worked in every situation. I would guess how much we would spend, write it down and they never look at it again. I made envelopes and then always forgot them when I was going to the store. The only thing that works for me is doing a budget every single month, and adding up what I actually spent at the end of the month so I can see where I might have overspent. Budgets won’t work unless you do.

Teaching Financial Literacy Will Set Them Up To Win

If you teach the basics of money management; budgeting, saving, investing, debt repayment and giving back to someone in high school you’re setting them up for a lifetime of (hopefully) good money decisions. Once someone understands the basics it’s up to them to follow the right path, but at least they’ll have a map in their hands!

What do you think? What do you wish you knew about personal finance earlier?

Pin it for later

One response to “Why Personal Finance Should Be Taught In School”

Leave a Reply

You must be logged in to post a comment.

Great post! I think you are absolutely right! Personal finance needs to be a priority to talk to high school and college level students.