Lessons Learned From One Year Of Debt Repayment

Paying Off Debt || Tags: Debt, Money ||It’s October, and about 1 year ago we declared war on our debt. I honestly can’t believe it’s been a whole year, and I can’t believe how far we’ve come. If you had told me last year that we actually did have room in our budget, I wouldn’t have believed you either.

Read our past updates:

Before I share the numbers with you, I wanted to share the biggest lessons learned in the past year of paying off debt:

Track Your Spending

You really don’t know where your money is going if you don’t track it. I didn’t think we’d have any extra money to send to our debt. I also had no idea how much money we were bringing in. It’s helped me to be more conscious of where our money is going, and make sure that we get the most bang for our buck!

Budget Every Month

In the past I would try to make a budget that would apply to all situations, and this simply does not work. Making a budget every month has given us a change to review our spending, and make adjustments for each month depending on our work/travel schedules, upcoming holidays, etc.

Here’s my advice for super simple budgeting

Getting Started Is Important

It’s so intimidating to get started, so we put it off. We just keep living the same way we always have. I am here to tell you that a year later the most important thing is that we chose to get started. We chose to make a change. It doesn’t really matter if you pay off $1000 or $10,000 of a debt in a year, the fact that you made a choice to pay off debt means you’re taking control.

You’re Not Always Going To Win

There are still some months where we spend more than we make. It doesn’t happen often but now I know about it so I beat myself up for it. Before we budgeted every month I was blissfully unaware. Some months the “win” is that we tried.

One Year Ago

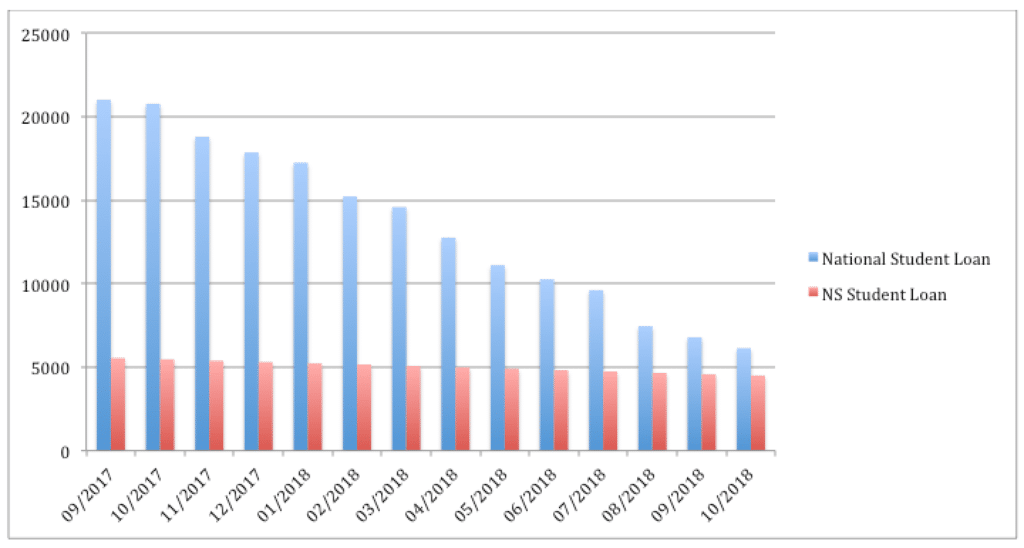

One year ago we decided to pay off the student loan debt that we had. It was $26,556.64. It seemed like such a big number, but I wanted it gone, so we gave ourselves 2 years to be debt free.

One of my Great Big Goals for 2018 was to be under $10,000 in debt! We’re so close, and we’ll definitely make it there by the end of 2018. The ambitious part of me wants to move the debt free goal date up because I’m fairly positive our debt will be gone before September 30 2019. However I would rather leave the date where it is and smash it out of the park than pick a new date and miss it 😉 I’ll decide at the end of the year if we move it up or not!

Today

Without further ado, we currently have $10,633.20 in debt.

This means we have paid off $15,923.44. OH MY GOD! I can’t wait until we are SAVING that much (or more!) instead of paying that much but we are more than halfway there!

The last 3 months we haven’t put as much down on the debt as I would have wanted, but with summer and time off, my income was a little lower than normal. I’m feeling ready to crush the last 3 months of 2018!

Leave a Reply

You must be logged in to post a comment.