Dealing With Debt Repayment Burnout

Finance Paying Off Debt || Tags: Debt, Money ||We’ve been on this debt repayment journey for 19 months. In that time we’ve paid off $22,744.34, which is amazing and I’m super proud of us for sticking to this process. That being said, I cannot wait until it is over.

Right now our debt is sitting at $3162.30, or about 12% of our original debt. Being that we’ve already paid off so much, I would think that the last 12% would go by super fast, but unfortunately it feels like it is dragging on.

I think what’s making it seem so tough is that every dollar we can put on the debt makes a big difference. I have been hoping to be debt free by the end of June, but I’m still not sure if that’s going to happen. So this week I realized that I think we’re suffering from debt repayment burnout.

Debt Repayment Burnout

Burnout typically happens to those of us paying off debt. You’ve been working so hard and probably depriving yourself of things that you wanted to buy so that you can pay off your debt faster. I think it makes it easier to realize that other people go through this too!

Dealing With Debt Burnout

I won’t lie to you, the last month has been harder than I thought. But there are some things you can do to help:

Keep your eye on the prize

I keep reminding myself of why I want to be debt free, and what my life will look like when we finally pay off the debt! I can’t wait to travel more, and hopefully be more flexible with our time.

Celebrate small wins

We don’t do enough of this! Celebrating small wins can help keep you motivated because you really feel the progress. Just don’t celebrate by spending a ton of money 😉

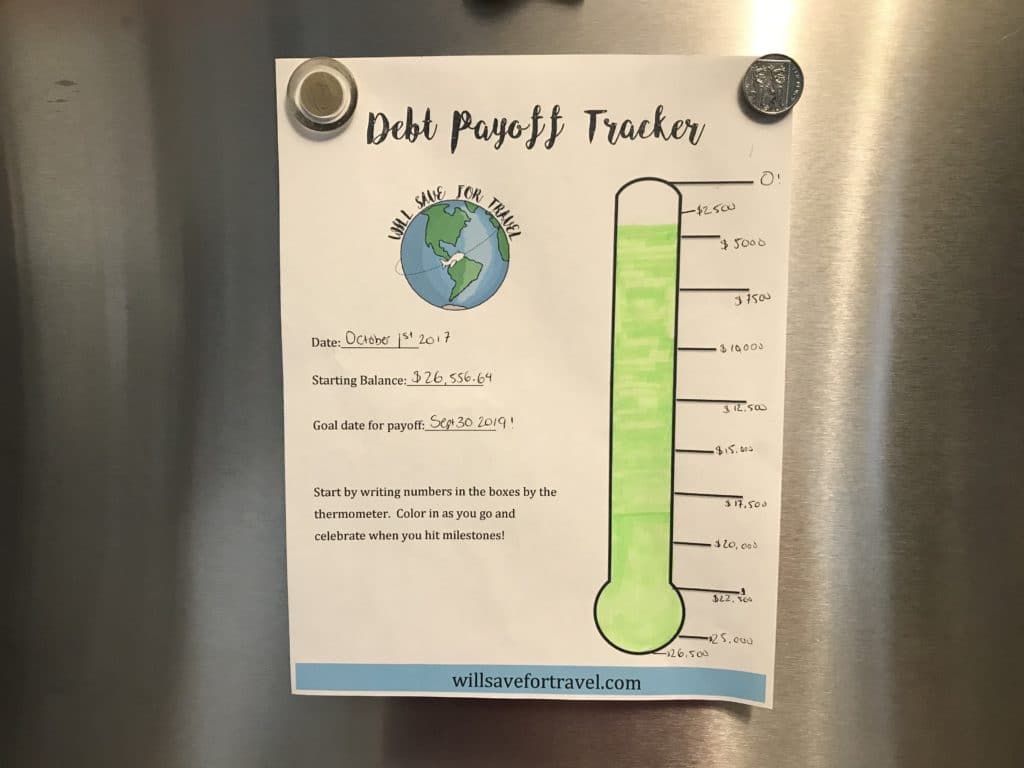

Track your progress

We have a progress tracker on our fridge! It is a great reminder to see how far we’ve come, and also serves as a reminder of our goals.

If you want your own debt repayment tracker, it’s available here with all my free resources!

Share your journey

I think one of the best ways to stay on track is to have a group of people to share your debt free journey with. Obviously I’ve chosen to share with all of you, but it could be a few close friends. Having people to talk to when you feel like spending can be so helpful. Check out #debtfreecommunity on instagram if you need some inspiration!

Budget in some fun

You can’t expect to go years without spending any money on yourself! Budgeting in fun is so important to staying on track. It may seem counterintuitive to spend money on fun things when you are in debt but depriving yourself for too long only leads to you rebelling and spending money eventually.

What’s Next?

We’re still working away at the debt! With this month having 3 pay checks, I’m still hopeful that we will be able to pay off a good chunk of what’s left of the debt! If you’re suffering from debt repayment burnout let us know in the comments so we can all cheer each other on!

Leave a Reply

You must be logged in to post a comment.